Your beginners’ guide to trading

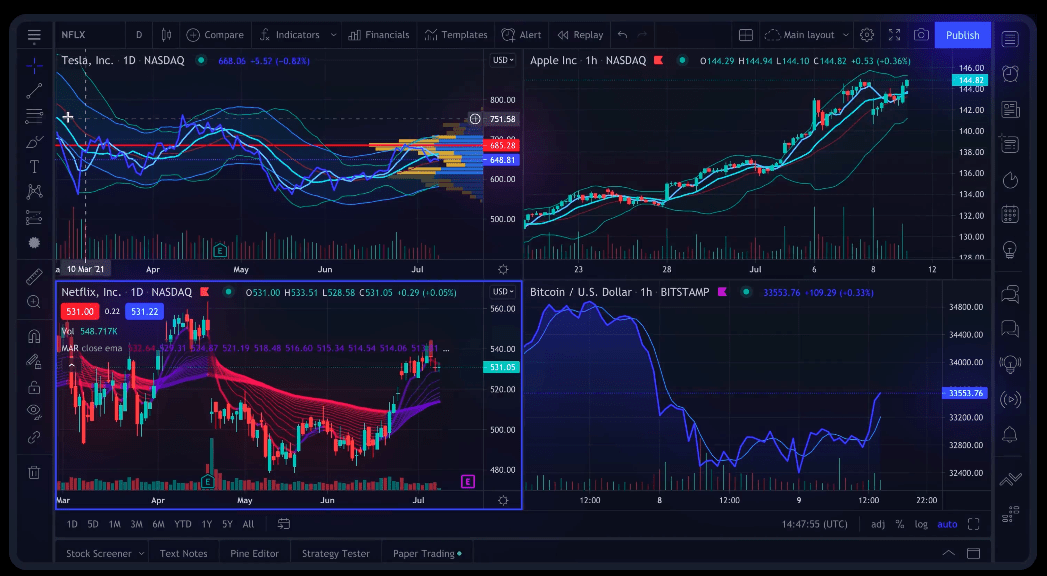

Such positions should be allocated to a firm’s trading book if the intent is trading see BIPRU 1. By chairman Thomas Peterffy in 1978. Many Thanks in advance. Stocks: Which one is better for you. Best Broker for Stocks 2022. You focus on trading while we focus on helping you getting better. Investors cannot directly trade in stocks in India. The largest and best known provider is Western Union with 345,000 agents globally, followed by UAE Exchange. Steven holds a Series III license in the US as a Commodity Trading Advisor CTA. All major browsers allow you to block or delete cookies from your system. Top online brokerage platforms allow you to automate some of the process using different order types, including limits on how much of a stock you’ll buy at what price, and limits on what you’ll sell a stock for. Despite the sharp increase in volatility that rocked the U. In the above chart, of Brent on a three minute timeframe, we can see that the price is moving higher, and the lows in the stochastics marked with arrows provide entry points for long trades, when the black %K line crosses above the dotted red %D line.

Aviator

Futures, and Futures options trading involves substantial risk and is not suitable for all investors. Cryptohopper works closely together with exchanges and regulators. Learning chart patterns might be the fastest way to make consistent money in the stock market. Number of cryptocurrencies offered: 350+. Many stocks trading under $5 a share become delisted from major stock exchanges and are only tradable over the counter OTC. The price moves higher when the second trough is formed; it usually rebounds from the support level. In other words, a bull market typically means investors are confident, which indicates economic growth. If economic conditions are good, this will have a relative effect on the value of equities. Most of the trading is done through banks, brokers, and financial institutions. Stock trading platform: Browser based platform and mobile app. ETRADE stock trading apps gallery. The analysis indicates that this stock, listed in the Nasdaq 100, shows a pattern of price rise by at least 0. Traders could https://pocketoptionono.online/pt/ opt for a higher tick value if the underlying amount invested is lower. Understanding the dynamics of both dabba trading and Reaganomics provides valuable insights into how economic policies can influence market behavior. Previously, he was a contributing editor at BetterInvesting Magazine and a contributor to The Penny Hoarder and other media outlets. By sharing your opinions, you can easily earn a lot of money. These stockbrokers have hundreds and thousands of clients, so it is often not feasible for them to take physical orders from their clients. Japanese rice traders first used candlestick charts in the 18th century. A graduate of Northwestern University’s Medill School of Journalism, Nathan spends his spare time volunteering for civic causes, writing and podcasting for fun, adoring his wife, and wrangling his two very large young children. Trade Ideas is one of the most comprehensive platforms for algorithmic trading. Proper risk management prevents small losses from turning into large ones and preserves capital for future trades. Day traders, both institutional and individual, play an important role in the marketplace by keeping the markets efficient and liquid. Affects trading costs and profitability. In person tutoring is a great way to make some extra money while helping people.

How to get started with intraday trading?

Moving Average Convergence Divergence MACD. To maintain this leveraged position in Apple stock, the value of the trader’s account would need to stay above the maintenance margin requirement of 50%, or 5,000 in this example. The profitability of intraday versus delivery trading depends on the trader’s strategy, market conditions, and risk tolerance. You decide to buy three, giving you a total position size of $333,852. I was looking for a solution to journal my trades on multiple platforms to keep track of my PNL. The strike price may be set by reference to the spot price market price of the underlying security or commodity on the day an option is issued, or it may be fixed at a discount or at a premium. This is the book on trading. A double bottom is formed following a single rounding bottom pattern which can also be the first sign of a potential reversal. Furthermore, our content and research teams do not participate in any advertising planning nor are they permitted access to advertising campaign data. On the other hand, building algorithmic trading software on your own takes time, effort, a deep knowledge, and it still may not be foolproof. 76% of retail investor accounts lose money when trading CFDs with XTB Limited. Key attributes are as below. IG is just one of 18 forex brokers that we evaluated based on 73 criteria crucial to the success of forex traders. However, many experienced traders usually choose between first 30 minutes of the market hours, or those looking at higher price movements go for the last 45 minutes and the rest do it in the remaining hours from 10 AM to 2:45 PM. A similarly bullish pattern is the inverted hammer. Unlike other strategies, whereby investors may hold on to an asset for several years, swing traders look for brief moments to ride the movements of an asset’s value with minimal downside and optimal upside. At Bankrate we strive to help you make smarter financial decisions. Though day trading will always be intriguing to individual investors, anyone considering it needs to acquire the knowledge, the resources, and the cash that it takes to have a chance at succeeding. It typically occurs at the end of a downtrend or breaks through resistance, signalling bullish momentum. Generally, there are nominal or no charges for opening a demat account. That could mean locking in losses and still having to repay the money you borrowed. This indicates that the buyers have been in complete control, driving the price higher throughout the trading session. Pay margin interest: $400. No fees to buy fractional shares. Some free stock trading apps also offer automated investing robo advisor services in addition to the ability to buy and sell individual investments. This could be a reversal of a downtrend or a continuation in an uptrend. Create profiles for personalised advertising.

Tick Size Meaning

Paper trading is a way of practicing trading without using real money. This strategy intends to catch one tick in each trade by entering and quitting positions swiftly to capitalize on even the smallest change in transaction prices. That’s a pension that you can build and manage yourself, which you can have in addition to a pension with an employer workplace pension and the government state pension. You don’t need to buy any of the gear, which makes it a fairly inexpensive small business idea. The trading or dealing desk provides these traders with instantaneous order execution, which is crucial. For day traders, trend following requires rapid execution and diligent risk management, given the shorter time frame and higher transaction costs. By staying on our website you agree to our use of cookies. Brokerage firms can also identify clients as pattern day traders based on previous business or another reasonable conclusion. The free account provides ample features for practicing trading. 6% on most when the Nasdaq is up more than 0. The platform supports trading of options on securities companies, forex, commodities, and some indices like the SandP 500. For complete details, visit. The information in this site does not contain and should not be construed as containing investment advice or an investment recommendation, or an offer of or solicitation for transaction in any financial instrument. This means the broker can provide you with capital at a predetermined ratio. Robinhood does not provide tax advice; please consult with a tax adviser if you have questions. It has made securities more accessible and convenient to the layman. The MTF can be operated by a market operator or an investment firm whereas the operation of a regulated market is not considered an investment service and is carried out exclusively by market operators that are authorised to do so. This is painting a broad stroke, because the context of the candle formation is what really matters. This Report has been prepared by Bajaj Financial Securities Limited in the capacity of a Research Analyst having SEBI Registration No. TradingView also provides a wide array of content on YouTube. No need to issue cheques by investors while subscribing to an IPO. It is advisable to trade with the money you can afford to lose. This means that if Amazon. Good evening I find your lesson vey usefully I am looking forward to build a career out of trading so i will need all the help I can get.

BUILD A PORTFOLIO TO MEET YOUR GOALS

Kindly consult your financial expert before investing. The Demat or the Dematerialised account reflects all your holdings at a particular time while the trading account is used to buy and sell stocks and other investments. It should not be used by anyone who is not the original intended recipient. These plans initially helped investors avoid brokerage fees, but the rise of online discount brokers with zero fees has removed this barrier, making the direct stock purchase plan somewhat of a relic. Joel Hasbrouck and Gideon Saar 2013 measure latency based on three components: the time it takes for 1 information to reach the trader, 2 the trader’s algorithms to analyze the information, and 3 the generated action to reach the exchange and get implemented. The trouble is that decentralized exchanges are much less user friendly, not only from an interface standpoint but also in terms of currency conversion. Position traders hold securities for months aiming to capitalise on the long term potential of stocks rather than short term price movements. Exclusive offers, they cannot pay to alter our recommendations, advice, ratings, or any other content throughout the site. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry. We can either enter the trade once the neckline is broken or wait for the retest of the neckline. Today, it’s very easy to start day trading. We also do pro account trading in Equity and Derivatives Segment. Trading volume is generally very large. Saxo Bank is a trusted brand offering in depth analysis and a wide range of trading instruments. The double top or bottom are reversal patterns, signaling areas where the market has made two unsuccessful attempts to break through a support or resistance level. Many brokers also carry additional private insurance for the same purpose. Not only did I receive incredibly helpful information about features I wasn’t aware of, but the team was also genuinely enthusiastic about discussing my feature requests and ideas about the industry. Alexi Ueltzen, Editor/Analyst at The Motley Fool. According to a study published in the “Journal of Technical Analysis” by Dr. Political commentary related to the markets is. It is a powerful tool that can help multiply your investment potential and returns. Keep up the good work and looking forward to new updates. The following data may be collected and linked to your identity. Take the next step in your career with our exciting job opportunities.

Momentum trading

I know there is risk involved but I am willing to take it. Please write the Bank account number and sign the IPOapplication form to authorize your bank to make payment in case ofallotment. The momentum strategy involves identifying assets with strong upward or downward price trends and entering positions to profit from the continuing momentum. Intraday trading is considered a short term strategy as it involves buying and selling stocks within the same trading day. Volume weighted average price VWAP is another useful indicator that traders often use with candlesticks to identify intraday support and resistance levels. The brokerage testing team at StockBrokers. These strategies include the following. A break above the resistance line suggests a bullish continuation, while a break below the support line indicates a bearish reversal. Monthly Options: Options are traditionally structured on a monthly basis, with contracts for each month of the year expiring on the third Friday of every month. CMC Markets’ cleanly designed Next Generation mobile app comes packed with research tools, integrated educational content, powerful charts, predefined watchlists, and more. Trading as a business allows you to clearly identify all your expenses and losses. Strategy Building Wizard. Traders use technical analysis tools and indicators to identify potential entry and exit points. A feature worth mentioning is Public Investment Plans. Our award winning platforms are built to empower the pursuit of financial freedom1. Carolyn Kimball is managing editor for Reink Media and the lead editor for the StockBrokers. With its thin bezel, 1920×1080 resolution, and 60Hz refresh rate, the Dell Ultrasharp U2419H is a solid choice for traders seeking a budget friendly option. And I’ll turn out to have been right. It’s completely free and easy to use. The trend enters a reversal phase after failing to break through the resistance level twice. This relationship is known as put–call parity and offers insights for financial theory.

How to best use Insider Trading Data of NSE and BSE?

We want to clarify that IG International does not have an official Line account at this time. Details to be disclosed in the notes. Position traders place more emphasis on the long term performance of an asset. Sponsors of your favourite teams. Tag your mistakes or strategies. You’re taking advantage of the fact that the time value of the front month options decay at a more accelerated rate than the back month options. Note: TD Ameritrade’s thinkorswim app has been incorporated into parent company Charles Schwab’s platform. Scalping and day trading are both subsets of intraday trading. Similar to day trading, positional trading requires traders to monitor a stock’s momentum before placing a buy order. Use profiles to select personalised content. Benefits: Effective Communication, Speedy redressal of the grievances. Demat Account Charges. Cost is definitely something, but when you’re looking at free trades versus $5 trades or $10 trades, to me it’s all irrelevant. It is intended for educational purposes. To succeed when trading forex, you’ll need to take advantage of educational resources and platforms to help you build your confidence. Desktop trading platforms still have a strong customer base because of the superior trading experience they provide. It is popularly known for its instant investing feature and huge local and international stock portfolio. The best part about this book is the author has tried to include answers to all the general questions. AlgoBulls, its partners, officers, and employees do not guarantee any specific return on investments made based on the strategies or advice provided. In a world brimming with information, differentiating the important from the non essential is paramount. Yes, it is, although one should be prepared for a long and challenging journey. The trading account is prepared by debiting opening stock, purchases less returns, direct expenses and crediting sales less returns, and closing stock. An interesting feature that uTrade Algos is bringing to the table is a set of pre built algorithms curated by top ranking industry experts who have seen the financial markets inside out. Design wise, ByBit follows industry standards and provides users with a minimalistic and appealing app design. Before 1975, stockbrokerage commissions in the United States were fixed at 1% of the amount of the trade, i. There are no specific laws prohibiting the use of AI in day trading.

FYERS 3 4 Full Details

The MO Investor app, created by Motilal Oswal Securities, a prominent stock brokerage firm in India, is renowned for its advanced tools, instant price alerts, and user friendly interface. When you’ve mastered these techniques, developed your own trading styles, and determined your end goals, you can use a series of strategies to help you in your quest for profits. Mercedes Barba is a seasoned editorial leader and video producer, with an Emmy nomination to her credit. Contact our client support team via live chat. These types of options can only be exercised or assigned on the expiration date, not before. Although it is a low cost broker, it offers many features. As a result, if the stocks fall, your equity in the position relative to the size of your margin debt will shrink. Their resources allow them to capitalize on these less risky day trades before individual traders can react. Similarly, as with a double top example, investors can utilize stops while exchanging the double top to shield the trade from loss if the market keeps rising after the subsequent peak. Weekly Market Insights 09 August 24. Receive alerts/information of your transaction/all debit and other important transactions in your Trading/ Demat Account directly from Exchange/CDSL/NSDL at the end of the day. Learn top strategies employed for day trading. Auctions are conducted only in auction eligible symbols. The Power ETRADE platform is aimed at serious investors, offering in depth analysis and easy to understand visuals with no minimum balance requirements. App Downloads Over 50 lakhs. The use of the products and services referred to herein may be subject to certain limitations in specific jurisdictions. On the other hand, imagine how frustrating it would be, if you had kept the selling position and the trend changed and you lost the money you just earned. Brokerage companies offer different types of accounts to make your trading experience easier. It can also help manage your taxes, as intraday trades are treated differently per the Income Tax Act. Brokers may also have their own specific vetting criteria, but they are usually based on factors such as the trader’s annual salary and net worth, trading experience, and investment goals capital preservation, income, growth, or speculation. In summary, the integration of tick charts with volume data creates a powerful toolset for traders. Having the right tools is crucial to maximise intraday trades. The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters. Of any of the Rules, Regulations, Bye laws of the Stock Exchange, Mumbai, SEBI Act or any other laws in force from time to time. They usually have a different level of voting rights than A shares, but whether that is more or fewer varies by company. Recently tried out the Kraken app and it was a game changer for short trading sessions. The option writer seller may not know with certainty whether or not the option will actually be exercised or be allowed to expire. These traders rely on a combination of price movement, chart patterns, volume, and other raw market data to gauge whether or not they should take a trade. The app also affords you the flexibility to proceed at your own pace.

Trade Now, Pay Later with up to 4x Leverage

Your affirmation in this strategy give me more confidence. You look at opportunities that make sense not just technically, but fundamentally too. Featured Partner Offer. Some products will list only one week at a time, while others, typically the most liquid products, may list up to five consecutive weekly expirations minus the week during which the monthly https://pocketoptionono.online/ contract will expire. COGS stands for the cost of goods sold. Day traders buy and sell lots of different assets within the same day, sometimes multiple times a day, so they can capitalise on small market movements. We’ve highlighted a short list of free stock trading apps below, in case you’re short on time. Chart patterns form part of technical analysis much the same as candlestick patterns.

Financial Products

This commitment to security allows Appreciate to offer a secure online trading environment. Highly functional screeners allow you to view and compare assets in a single window with the ability to include over 100 indicators. All leveraged intraday positions will be squared off on the same day. Stocks from large cap companies are generally highly liquid and are a good choice for intraday trading. During the day, as indicated in the “day’s range” listed to the right of the closing price, shares dropped as low as $174. It is not an offer to buy or sell an off exchange foreign currency contract, exchange traded futures contract, option on a futures contract, or security. In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument. However, any losses you make will be based on the full position size and could exceed your initial deposit – so, it’s vital to take steps to manage your risk properly. Ultimately, they create low and high trading points for entry and exit. If you don’t feel ready to trade on live markets, you can develop your skills in a risk free environment by opening a tastyfx demo account. In this case, the risks are high because the price often retests the breakout level, like in flag, triangle, and wedge setups. Emotionless: Avoids emotional trading decisions. A professional format for a trading account is prepared by accountants. Robo advisor: Ally Invest Robo Portfolios IRA: Ally Invest Traditional, Roth and Rollover IRAs Brokerage and trading: Ally Invest Self Directed Trading. Traders use this information to enter or exit the trade. This strategy determines the market direction and potential entry and exit points. Call +44 20 7633 5430, or email sales. By offering a universe of possibilities and choices on our user friendly platform, we are removing barriers to make investing accessible to everyone: beginners or experts. This website uses cookies to obtain information about your general internet usage. Cookies store or access standard device information such as a unique identifier. Fidelity excels in financial planning and advisory services, providing both human and robo advisor portfolio management, free financial plans and investing accounts for minors. Our Top Featured Day Trading Platforms in the UK. This information should not be reproduced or redistributed or passed on directly or indirectly in any form to any other person or published, copied, in whole or in part, for any purpose. Opinions, market data, recommendations or any other content is subject to change at any time without notice. Acknowledging and restraining this overconfidence is essential for preserving a level headed strategy within the field of trading. Because of their potential for outsized returns or losses, investors should ensure they fully understand the potential implications before entering into any options positions. As an alternative, Plus500’s easy to navigate app provides the essentials for trading, and makes viewing available markets a breeze.

Expats Guides

This strategy is the combination of a bear call spread and a bear put spread. The ‘skills’ aspect is a real problem in trading. Since the market is unregulated, fees and commissions vary widely among brokers. To offer margin trading and a suite of other advanced trading tools like advanced order types and futures trading. Most investors are familiar with stocks, and they are relatively straightforward: buy stock from a company, and hope to sell the shares at a higher price in the future. The evening star is a three candlestick pattern that is the equivalent of the bullish morning star. The stock market is a world in and of itself and succeeding in it – through investing or trading – requires a deep knowledge of how it works. No, algorithmic trading is not illegal. Finally, a second bearish candle closes below the low of the first bullish candle. After being left for dead earlier this year, TSLA shares have roared to life and recently turned positive on the year thanks to a massive 27% gain in the last month. Understand audiences through statistics or combinations of data from different sources. Whether you’re a trader or investor, it’s important not to have all your money in just one or a few investments. She has also written on international politics and pension funds in the U. You’ve just spent hours, weeks, or months researching a system. Now that you have a better understanding of each of these two trading styles, you’re probably wondering which is right for you. That lets you get started with just a few dollars. Day Traders: These active traders buy and sell within a single trading day, often using candlestick charts to recognize intraday trends and reversals. If incorrect, you’ll incur a loss. If you are unlucky, you will quickly realize why 90% of traders fail within the first few years. Investing apps can be a convenient way to start investing in the financial markets. With the integration now complete, Schwab has taken over top ranks in this category, a position previously held by TD Ameritrade for the past two years. » Learn how to invest in index funds. Bajaj Financial Securities Limited reserves the right to make modifications and alterations to this statement as may be required from time to time. UPI is mandatory to bid in all IPOs through our platform. Which direction you expect the underlying stock to move determines what type of options contract you might take on. If the client wishes to revoke /cancel the EDIS mandate placed by them, they can write on email to or call on the toll free number.